Apa Itu Marcellus Shale?

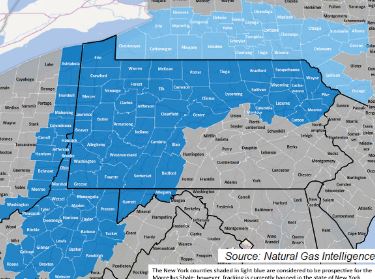

Marcellus Shale adalah formasi geologi yang terletak di Amerika Serikat bagian timur laut, terutama di negara bagian Pennsylvania, West Virginia, dan New York. Formasi ini dikenal sebagai salah satu sumber gas alam terbesar di Amerika, bahkan di dunia.

Sejarah dan Potensi Produksi

Aktivitas pengeboran di Marcellus Shale mulai melonjak sejak 2008 dengan metode fracking (hydraulic fracturing) dan horizontal drilling. Potensi gas yang terkandung di dalamnya diperkirakan mencapai lebih dari 500 triliun kaki kubik (TCF).

Dampak Ekonomi dan Energi Nasional

Produksi gas dari Marcellus telah mendorong Amerika Serikat menjadi eksportir energi bersih. Harga gas alam menurun, ketergantungan terhadap impor menurun drastis, dan ribuan lapangan kerja baru tercipta.

Tantangan Lingkungan

Meski memberi manfaat ekonomi besar, eksplorasi Marcellus Shale juga menimbulkan kekhawatiran lingkungan: pencemaran air tanah, peningkatan aktivitas seismik, serta emisi metana dari proses fracking.

Masa Depan Marcellus Shale

Keberadaan Marcellus menjadi krusial dalam transisi energi Amerika menuju sumber energi domestik yang lebih bersih. Namun, tekanan untuk menerapkan teknologi eksplorasi yang lebih ramah lingkungan semakin besar.